Wealth comes from the growth of assets (cash, stocks, property, or any other asset). Assets are purchased with income. If you do not put aside part of your income to acquire assets, you will find it extremely difficult to acquire wealth. However, if you do put aside part of your income to acquire assets, you will find it very easy to acquire wealth. It is all very simple.

Just to summarize:

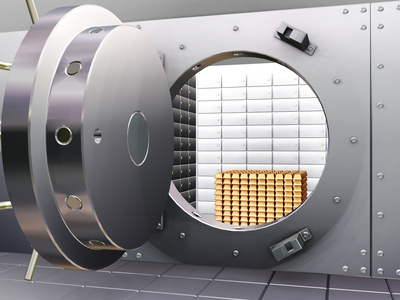

No savings = no investment = no wealth growth

You can’t invest what you don’t have. So the first step is to, guess what, save some money! Not once, but consistently and systematically. But look at it like this:

Let’s make up a simple example for illustration. Let’s say one week is composed of 10 days. And let’s say you work for all those 10 days. You earn $100 each day. This is week 1. By the end of week one, you have earned 10 x $100 = $1,000. Now, if you spend the entire $1,000 and you have none of it left by week 2 (or even by week 30 or week 200), your entire efforts for week 1 have evaporated! You have nothing left to show for your efforts. Nothing!

What were you working for? For who? You gave away all your money. You paid everyone else except yourself! Now, here is something you should know: No successful corporation or wealthy individual does that! None! And if you are doing it, then it shouldn’t be a surprise that you aren’t accumulating wealth. So how should you live if you wish to start accumulating wealth?

Well, let us continue with our example. In week 1, you would keep the money you earn on day 1 (so you keep 10% of your income), and spend the money you earn in the remaining 9 days. And you would do the same in week 2, in week 3 and in every week.

No matter what, you would keep that contract with yourself, the contract to pay yourself first. It is honoring you, valuing yourself. It is a testament that you believe that you have a future worth investing in. it is a testament that you value your work, your income, what you make for yourself. You don’t pay everyone else and remain with nothing! Why on earth would you do that when it is your money! You deserve to keep part of it; after all it is you who earned it.

So, even in week 200, you would still have with you the 10% from week 1, week 2, and every other week. And you wouldn’t keep this money so you can spend it on a holiday, car or something like that (that should come out of your other 9 days). You keep it so that it can work for you, bear children for you, and make you more of its own. You worked for it, and now it’s time to have it work for you.

So, you invest it right from the beginning. So by week 200, you would still have with you the 10% from week 1 plus its children (what it has earned in your investment), week 2 plus its children, and every other week plus their children.

And because you are reinvesting your returns (the children the money bears), your investment will be compounding itself, so the children themselves will be bearing children of their own, into many generations. The gains you made in week 1 will be re-invested and they will earn more money themselves in week 2 and so on, and that money itself will earn more money in week 3 and so on…

And this just grows into what you call wealth, generations upon generations of your money earning for you. And it all starts when you honor yourself enough to ensure that no matter what happens, you keep at least 10% of what you earn every week! You pay yourself first.

Now, as your investments grow, you are of course entitled to enjoy some of your money, but you must remember that keeping it invested is what gets it growing. So, you may choose to spend, say, 30% of your investment gains (your returns) and re-invest 70%.

Arrange your life so that, no matter what, no matter what, you keep at least 10% of your income every week. And don’t spend and hope some will be left over to save and invest. Pay yourself first, first, before the bills, the gasoline, the food, the clothes, the … Pay yourself first.